Capital markets identify and direct your investment to the most promising businesses. Individual and institutional investors, governments, and corporations are regularly benefitted from capital markets. Capital is raised through equity and debt and is used to grow businesses and make financial investments. This helps in a growing economy and creates jobs and wealth. In the current scenario, the global pandemic has changed our perspective about the future. But any long-term investor needs to stay on track, regardless of challenges at the moment.

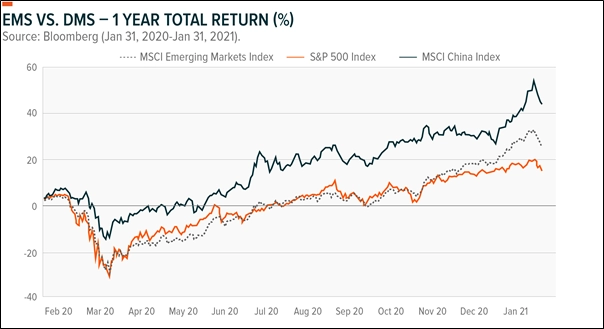

The S&P 500 Index has surged 17% since November 1, propelled to record highs by a hopeful outlook fueled by vaccine approvals, greater economic stimulus, and the Democratic Party’s victory in Congress and the White House.

Emerging markets, on the other hand, have risen even faster, with the MSCI Emerging Markets Index up 26% in that time.

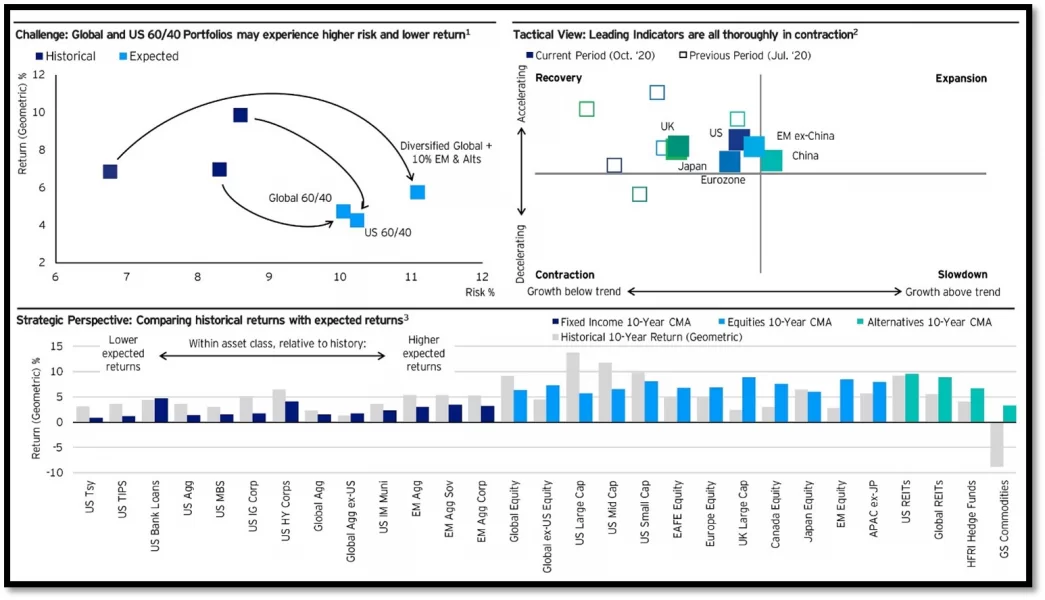

Figure 1- Long-Term Capital Market Assumptions

Here are five main reasons why we expect that outperformance to continue:

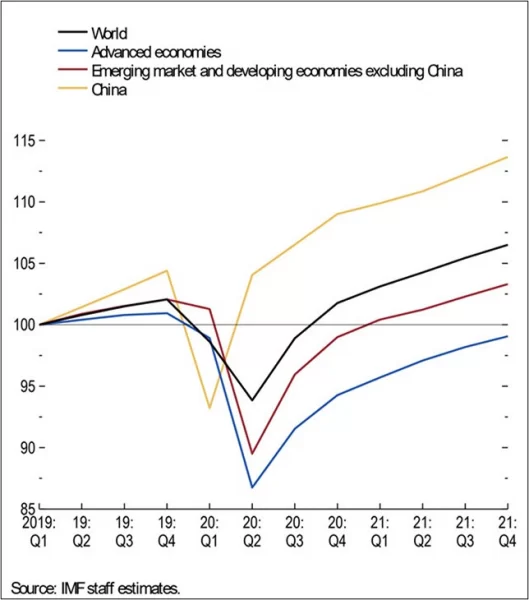

Figure 2- China’s Economic Recovery

1. The rebound of china’s economy following the pandemic would likely stimulate global growth in emerging markets, particularly in asia

While most developed markets, including the United States, expect to emerge from recession by the end of the second quarter, China’s economy grew by 2.3 percent in 2020. Even more importantly, government support was not a primary driver of economic expansion, providing policymakers more leeway to intervene if the economy falters. Moreover, as of December, its exports to the United States had recovered to 2018 levels, indicating that it had withstood the impact of US tariffs and trade tensions in 2018-19. Furthermore, its portion of overall worldwide exports reached an all-time high of 14.3 percent last year.

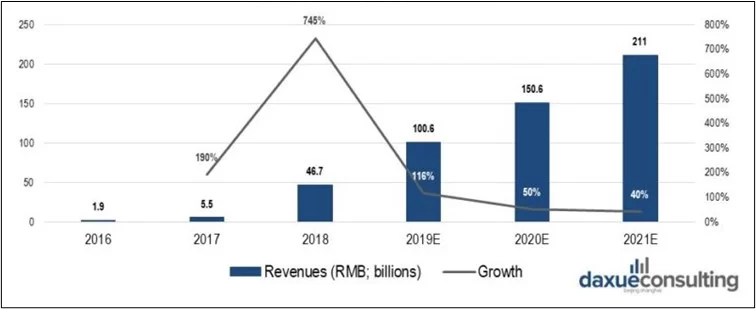

2. China’s consumer demand is becoming increasingly vital for global business earnings

Figure 3- Changes In China’s Consumer Demand

Continued global economic growth should be fuelled by the increasing middle class, particularly in Asia’s other rising markets. According to Morgan Stanley & Co.’s economics team, China’s GDP will increase by 9% in 2021, while total emerging market growth will be 7.4%. Profits for emerging market corporations might increase by 30 percent to 35 percent as sales develop.

There is no such thing as a “typical Chinese consumer.” There are four tiers of Chinese customers.

- Shakers and Movers

China’s wealthiest citizens already account for a sizable portion of global high-end goods consumption. As the country develops, its purchasing habits will continue to shape trends.

- The Urban Middle

This is the limited middle class of China. Because nearly half of them are employed by the government, programs aimed at increasing income will have a significant impact.

- The Urban Masses

This category, which includes blue-collar workers and migrant workers who have relocated to cities in search of better-paying jobs, is likely to enjoy the most income growth. This will allow them to spend more money on things other than necessities.

- The Rural Workers

Rural areas still house half of China’s workforce. With lower incomes and fewer job opportunities, they focus their expenditures on necessities like food and housing.

The white-collar “Urban Middle” and the blue-collar “Urban Mass” will be the driving forces behind future growth.

In China, approximately half of all personal spending is spent on food and clothing. Those consumption patterns will shift as disposable incomes rise. However, affordability will remain a problem, particularly for the urban masses.

3. Currency fluctuations may be advantageous to emerging markets

While emerging market currencies have not been immune to the current bout of global risk aversion, fundamental gains made by emerging countries over the last decade have enabled them to weather the current turbulence with substantially greater market confidence than in the past. In these nations, investing in local currency allows investors to benefit from high real local interest rates as well as significant interest rate differentials relative to US dollar interest rates.

We predict continuing U.S. dollar depreciation and good commodity prices to help keep many emerging market companies afloat. Furthermore, emerging market inflation is low, and many nations’ finances are sound, implying that global currency dynamics will continue to be good.

4. Based on rates and earnings, emerging-market values are very attractive

In a world where $17 trillion of developed-market sovereign debt has practically negative rates, emerging-market fixed-income instruments remain a haven of positive real rates. When compared to the S&P 500’s current forward ratio of roughly 23 times, current price-to-earnings ratios, at 16.2 times ahead of earnings expectations, provide comparable values.

Figure 4- Emerging Market Growth

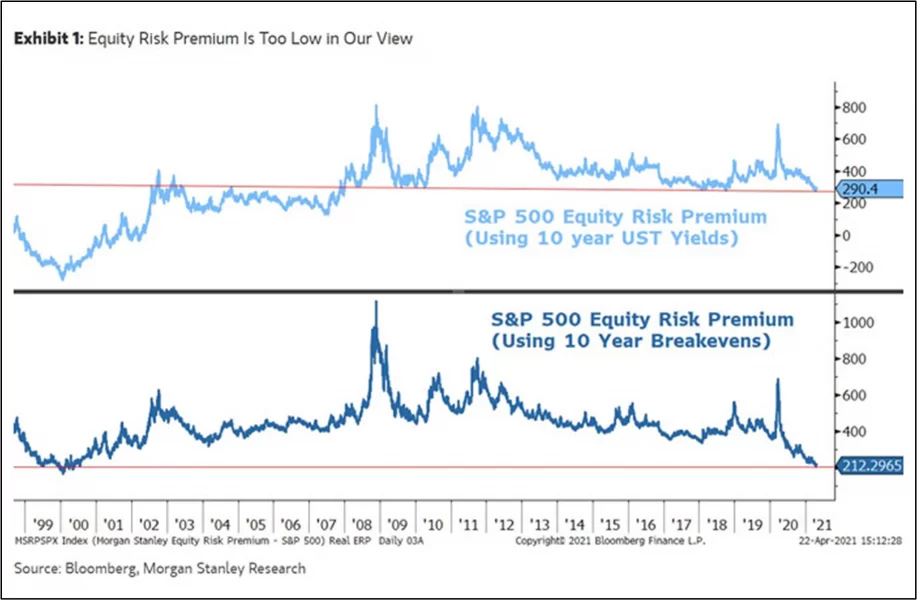

5. More upside is predicted by the equity risk premium

An investor must expect a higher return than the risk-free rate of return to invest in stock; this higher return is known as the equity risk premium since it is the additional return expected for an investor to engage in equities.

The equity risk premium is the difference in return between a low-risk and a high-risk investment. Emerging-market equities currently provide a nine-percentage-point premium, or approximately three times the S&P 500, when measured against the 10-year US Treasury. This contrasts with previous periods of peak emerging-market relative performance, when the equity risk premium decreased to between two and four percentage points, implying that the cycle for emerging-market equities may just be getting started.

For the past two decades, China has been a prominent theme in emerging markets. The gradual opening up of China’s domestic equities and bond markets, and their eventual inclusion in global emerging indices, is to be considered as a major characteristic of this decade.

To be sure, emerging-market gains may stall when vaccination rollouts meet temporary snags, but we believe there are larger dynamics at work that will underpin relative outperformance over the next few years. Any profits in the long-outperforming US market should be redirected to actively managed developing markets funds, with an emphasis on Asia.